this post was submitted on 10 Sep 2024

1778 points (97.6% liked)

Microblog Memes

5726 readers

2329 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

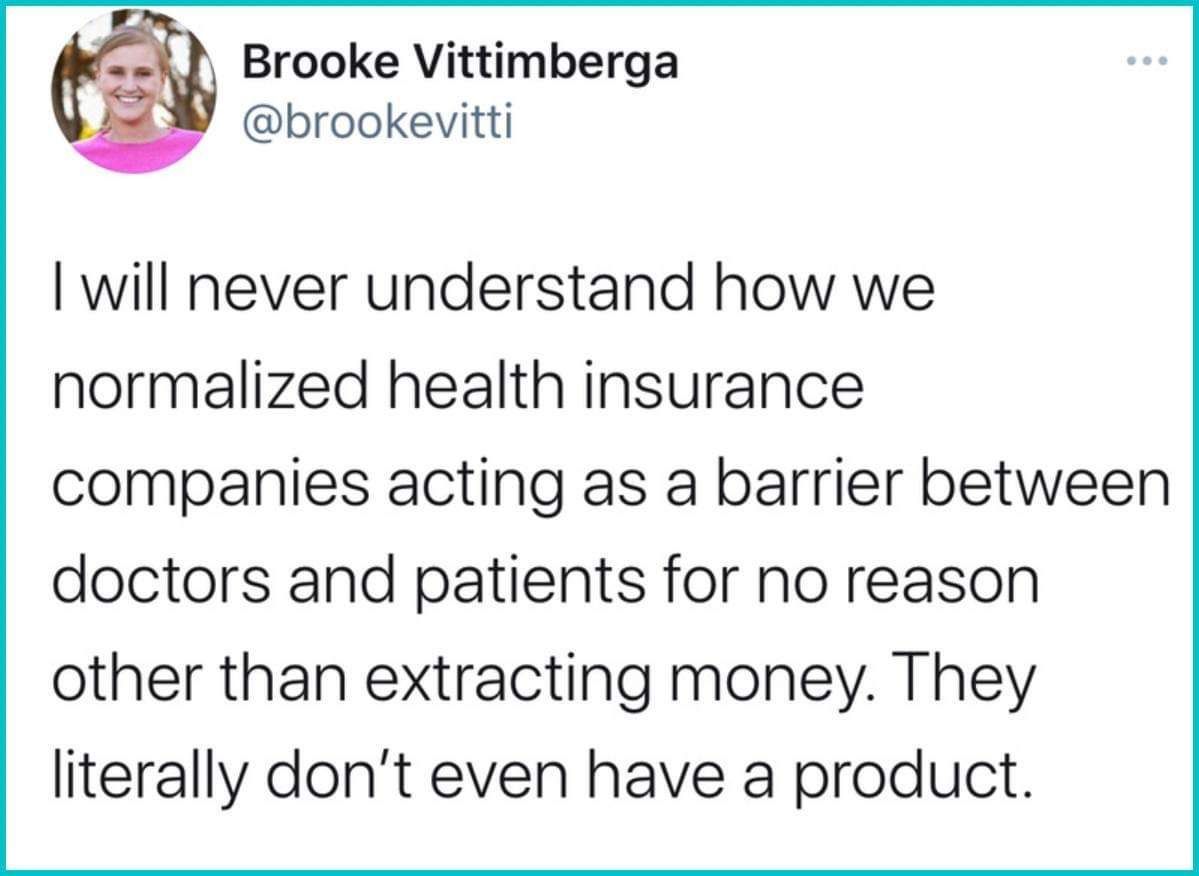

Well, they also profit from healthy people who don't use their insurance much.

nope

They literally do?

Customers that pay their premiums for years without actually needing healthcare is literally free money for them.

im not sure why you think the money coming in from premiums isnt the same money used to pay claims, but you go ahead and believe whatever you want.

the fact is we have to pass laws forcing them to spend a percentage of their profits on claims. their income is premiums their output is either claims, profit or operating costs.

their profit comes solely from them denying claims. if they paid all claims they would have no profit.

The argument the person above you is making is that they also profit off people who never file claims in the first place. In fact those people are more profitable since they do not consume labor to process claims.

The Byzantine system of rules and coverage exemptions exists to disincentive people from filing claims just as it exists to give leeway to deny them.

Of course the overall point that paid claims must be less than premiums charged (and investment income) is correct.

And I'm not sure why you'd assume I think that.

You're saying they make their money from denying claims, rather than from premiums paid by the healthy, which they then keep by denying claims from the sick (who also pay them premiums), is a distinction without a difference.

Well, yeah. If someone claimed I owed them $20m because their dog died, I'd deny that too (unless it was life insurance for a show dog or something).

Insurance was originally profitable because the idea was to bring in more money than you pay out, but set the margins so it's worth paying for as a service (covering things so the cost of a payout is high to make the service worthwhile, but the chances of actually paying out are low, to make the service profitable).

However, over time you are correct that it shifted to focusing on finding ways of putting profits over quality; which came with all kinds of legalese to avoid payouts, among other things (like rigging the healthcare system so the cost is always high, so their costs appear low in comparison).

So you're kinda right, but you seem to be conflating the American insurance market with insurance as a concept.