this post was submitted on 08 Jun 2024

69 points (100.0% liked)

chapotraphouse

13816 readers

807 users here now

Banned? DM Wmill to appeal.

No anti-nautilism posts. See: Eco-fascism Primer

Slop posts go in c/slop. Don't post low-hanging fruit here.

founded 4 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

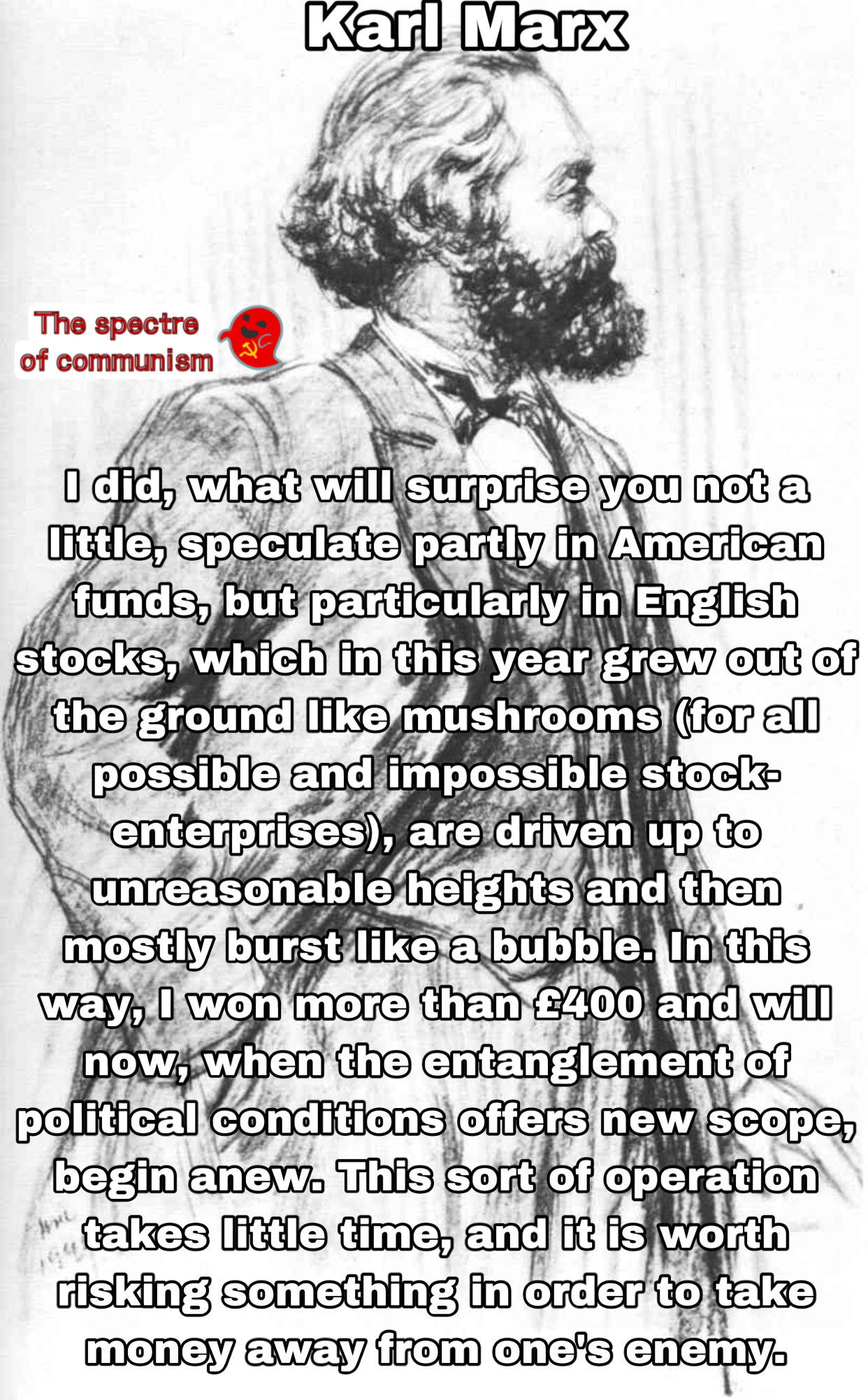

Anyone here do stocks? I did one of those hypothetical stocks things and was only able to make profits on weapons companies, which I obviously don't want to do with real money.

Any tips? Seems like it's the sort of thing that's silly not to do, but it's hard to find information that isn't from grifters with online courses to sell.

I used to. It's insanely difficult to consistently beat the market, but with a small personal account, is still realistic if you only focus on places where institutional money won't be playing, like short term trading low volume stocks

You can also do long term investing with a personal edge, whether that be knowledge from your industry, or culture, or environment, etc. I.e. it was super obvious if you were a student that Chegg would smash their first earnings during COVID, and is something Wall St. overlooked because they're not in school anymore

I did well trading black swan microevents on individual stocks/coins but I quit because it was genuinely a full time jobs worth of effort to keep up with all the information. Any method of consistent gains will take dozens of hours of reading or analysis every week. Just throw your money into an index and live your life imo, especially since most people still lose after spending all that time

Finance firms put a huge amount of effort into short term trades, so it's really hard to beat them at that. But they also don't really consider any term longer than a financial quarter, so you can outperform the market over a few years with basic business sense.

Just look for boring companies and research them. By boring I mean companies that make, like, steel, or fertilizer, or pickles. Ask yourself whether their customers can actually afford to buy their thing (good for steel and fertilizer since they sell to companies, bad for pickles since consumers have no money). Check their earnings reports for their upcoming plans - paying down their debt is great, maintaining steady business and paying out dividends is good, expanding is risky if they're doing a lot of it, diversifying is generally bad (you can do that yourself by buying a different company, and they're usually diversifying by following the latest hype train).

However, the post-COVID stock market makes no sense to me. I haven't been trading since 2020.

If you want to actually make money and not gamble, investing in market-cap weighted funds like VT will get you the most stable returns possible.

Day trading is gambling with some level of hallucinated foresight.

I used to be involved in this line of work as my full time job. I get why people here think there has to be a way to make some money on speculating in the market… but there really isn’t. Even the biggest Wall Street firms and hedge funds have a very hard time just beating the market.

Trying to beat the market or pick stocks is basically gambling. Which is fine! Gambling is fun. Just be sure to treat it like gambling and only put in the kind of money you would at a casino or something. Certainly not as some way to earn enough to stop working or buy a house or something.

If the stock markets didn't outpace inflation, nobody would own stock.

The NASDAQ is doubling consistently every 5-6 years, with an average yearly growth of 13-14%. The FTSE 100 is not as fast but still grows like a slime mold on agar.

Owning stocks in durable companies will always pay off well in the long run.