this post was submitted on 31 Jan 2024

124 points (100.0% liked)

Earth

12850 readers

1 users here now

The world’s #1 planet!

A community for the discussion of the environment, climate change, ecology, sustainability, nature, and pictures of cute wild animals.

Socialism is the only path out of the global ecological crisis.

founded 4 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

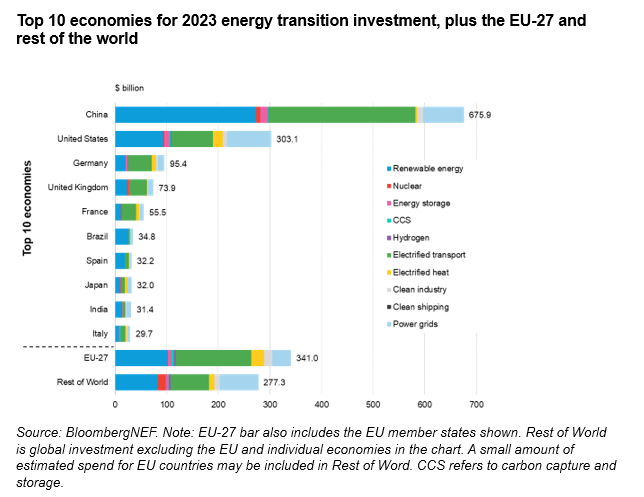

Assuming these are already all in US dollars.

United States:

3.031 x 10^11 dollars / 3.36 x 10^8 people = $902.1/person

China:

6.759 x 10^11 dollars / 1.45 x 10^9 people = $466.1/person

Adjusted for a PPP of 3.62, this is the equivalent of $1685.79/person.

In other words, the US almost doubles China’s per-capita spending, but if you adjust for PPP it’s the other way around. And of course China’s raw spending is about double the US’s.

I've never fully understood the full impact of what PPP really means - Does this mean China are committing more 'productivity' or 'resource' to renewables per capita? Or does it just mean that they're committing more relative to their GDP/quality of life?

China purposely devalues the CNY against the USD. I believe that they do this because it's beneficial for international trade. China's investment in these areas is in CNY and therefore, just converting it to its value in USD doesn't give a true comparison of the value of investment. PPP takes a collection of various commodities in both countries and compares their domestic prices with each other. This gives us the PPP adjusted value of investments in USD. Hopefully I got that right.

Having a weak currency facilitates other countries buying your products, so it's useful for an export economy - but it prevents you from importing as easily. The opposite is true for having a strong currency, and this dynamic drives a lot of things like de-industrialization in strong currency countries and unequal exchange extracting wealth from weak currency ones.