I can tell you what I would do with $424m, disappear. I'd still do good with most of it but I'm going to leave human society and go join a herd of elephants.

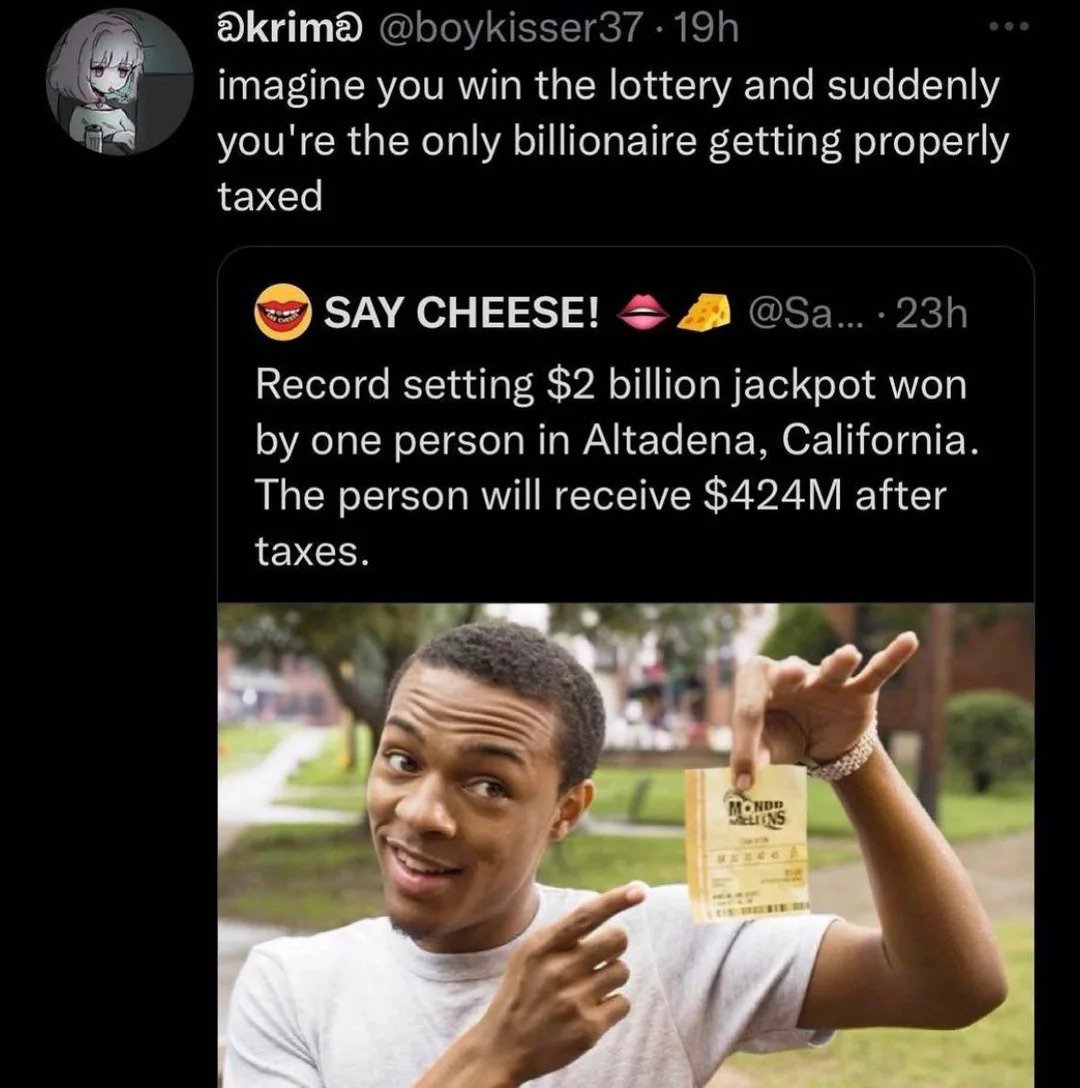

idk what's worse. the punchline of this joke, with pre-existing elites not being taxed, or the fact that someone could look at recieving 420 million, and find an excuse to get mad about it

196

Be sure to follow the rule before you head out.

Rule: You must post before you leave.

Other rules

Behavior rules:

- No bigotry (transphobia, racism, etc…)

- No genocide denial

- No support for authoritarian behaviour (incl. Tankies)

- No namecalling

- Accounts from lemmygrad.ml, threads.net, or hexbear.net are held to higher standards

- Other things seen as cleary bad

Posting rules:

- No AI generated content (DALL-E etc…)

- No advertisements

- No gore / violence

- Mutual aid posts are not allowed

NSFW: NSFW content is permitted but it must be tagged and have content warnings. Anything that doesn't adhere to this will be removed. Content warnings should be added like: [penis], [explicit description of sex]. Non-sexualized breasts of any gender are not considered inappropriate and therefore do not need to be blurred/tagged.

If you have any questions, feel free to contact us on our matrix channel or email.

Other 196's: