Image is of German farmers blocking the road near the Brandenburg Gate in early January 2024.

The ruling German coalition - the FDP, the SPD, and the Greens - has been in dire straits since the war in Ukraine began due to their steadfast commitment to destroying their country as much as possible in solidarity with Ukraine destroying themselves too. Scholz is deeply unpopular, with a record low approval of 20%, and his party's approval is even lower.

The German left has been entirely unable to take advantage of this situation, with Die Linke fragmenting due to split opinions on what position they should hold on Ukraine, among other issues. As a result, the major conservative party, the CDU, has gained a lot of voters over the past couple years. Most worrying, however, is the gains that the fascist party, the AfD, has made - from 10% in 2021 all the way to ~20% today. A significant chunk of the vote is likely protest votes due to the lack of an alternative, but a vote for fascists makes you a fascist nonetheless.

Recent controversies with the AfD - including an allegation that they held a secret meeting discussing a plan to mass-deport millions of migrants in an obvious parallel to Nazi meetings planning to remove all Jews from the country - has recently slightly damped approval for the AfD. This meeting generated counter-protests and condemnation from many Germans. It was later revealed that the meeting might not really have happened as alleged, but it doesn't actually matter, because the AfD's stance is being increasingly reflected by the ruling coalition, who recently introduced a bill allowing faster deportations of rejected asylum seekers and significant new powers for authorities in that regard, including potentially the criminalization of sea rescue organizations and imprisonment for aid workers.

The German government is increasingly considering banning the AfD, with their anxiety and motivation to do so rising as the AfD maintains and improves its position as Germany heads towards elections in late 2025. There are intermediate steps that could be done, such as revoking state funding, but if that doesn't work, then the party might well be banned. While I will never argue with fascist parties being banned, this probably won't fix anything, as the underlying economic and social conditions that are fueling these electoral shifts in the first place are not improving. Germany, the largest industrial power in Europe, is mired in a recession, particularly a manufacturing recession, from which there appears to be no escape. It has so far carefully shepherded its natural gas resources to keep the population as mollified as possible, but this has come at the expense of industry. In a trend starting from July 2022, manufacturing PMIs are still well below 50, reaching 45.5 in January 2024, which indicates decline. I suppose if you wanted to look on the bright side, it's better than it was in July 2023, where it was a whopping 38.8, so the rate of decline is becoming a little slower.

And this is just the domestic stuff. Germany has also famously sided with Israel to support them during the ICJ genocide case, has kowtowed to Netanyahu as they bond over being Genocide Experts, and maintains its support of Ukraine, continuing to send military gear and money to be converted to scrap metal by Russian artillery - rather than spending money on doing anything about the cost of living. In the face of a historic economic downturn, it has only more fervently stated its desire to remain militarily opposed to Russia for decades.

The Country of the Week is Germany! Feel free to chime in with books, essays, longform articles, even stories and anecdotes or rants. More detail here.

The bulletins site is here!

The RSS feed is here.

Last week's thread is here.

Israel-Palestine Conflict

Sources on the fighting in Palestine against Israel. In general, CW for footage of battles, explosions, dead people, and so on:

UNRWA daily-ish reports on Israel's destruction and siege of Gaza and the West Bank.

English-language Palestinian Marxist-Leninist twitter account. Alt here.

English-language twitter account that collates news (and has automated posting when the person running it goes to sleep).

Arab-language twitter account with videos and images of fighting.

English-language (with some Arab retweets) Twitter account based in Lebanon. - Telegram is @IbnRiad.

English-language Palestinian Twitter account which reports on news from the Resistance Axis. - Telegram is @EyesOnSouth.

English-language Twitter account in the same group as the previous two. - Telegram here.

English-language PalestineResist telegram channel.

More telegram channels here for those interested.

Various sources that are covering the Ukraine conflict are also covering the one in Palestine, like Rybar.

Russia-Ukraine Conflict

Examples of Ukrainian Nazis and fascists

Examples of racism/euro-centrism during the Russia-Ukraine conflict

Sources:

Defense Politics Asia's youtube channel and their map. Their youtube channel has substantially diminished in quality but the map is still useful.

Moon of Alabama, which tends to have interesting analysis. Avoid the comment section.

Understanding War and the Saker: reactionary sources that have occasional insights on the war.

Alexander Mercouris, who does daily videos on the conflict. While he is a reactionary and surrounds himself with likeminded people, his daily update videos are relatively brainworm-free and good if you don't want to follow Russian telegram channels to get news. He also co-hosts The Duran, which is more explicitly conservative, racist, sexist, transphobic, anti-communist, etc when guests are invited on, but is just about tolerable when it's just the two of them if you want a little more analysis.

On the ground: Patrick Lancaster, an independent and very good journalist reporting in the warzone on the separatists' side.

Unedited videos of Russian/Ukrainian press conferences and speeches.

Pro-Russian Telegram Channels:

Again, CW for anti-LGBT and racist, sexist, etc speech, as well as combat footage.

https://t.me/aleksandr_skif ~ DPR's former Defense Minister and Colonel in the DPR's forces. Russian language.

https://t.me/Slavyangrad ~ A few different pro-Russian people gather frequent content for this channel (~100 posts per day), some socialist, but all socially reactionary. If you can only tolerate using one Russian telegram channel, I would recommend this one.

https://t.me/s/levigodman ~ Does daily update posts.

https://t.me/patricklancasternewstoday ~ Patrick Lancaster's telegram channel.

https://t.me/gonzowarr ~ A big Russian commentator.

https://t.me/rybar ~ One of, if not the, biggest Russian telegram channels focussing on the war out there. Actually quite balanced, maybe even pessimistic about Russia. Produces interesting and useful maps.

https://t.me/epoddubny ~ Russian language.

https://t.me/boris_rozhin ~ Russian language.

https://t.me/mod_russia_en ~ Russian Ministry of Defense. Does daily, if rather bland updates on the number of Ukrainians killed, etc. The figures appear to be approximately accurate; if you want, reduce all numbers by 25% as a 'propaganda tax', if you don't believe them. Does not cover everything, for obvious reasons, and virtually never details Russian losses.

https://t.me/UkraineHumanRightsAbuses ~ Pro-Russian, documents abuses that Ukraine commits.

Pro-Ukraine Telegram Channels:

Almost every Western media outlet.

https://discord.gg/projectowl ~ Pro-Ukrainian OSINT Discord.

https://t.me/ice_inii ~ Alleged Ukrainian account with a rather cynical take on the entire thing.

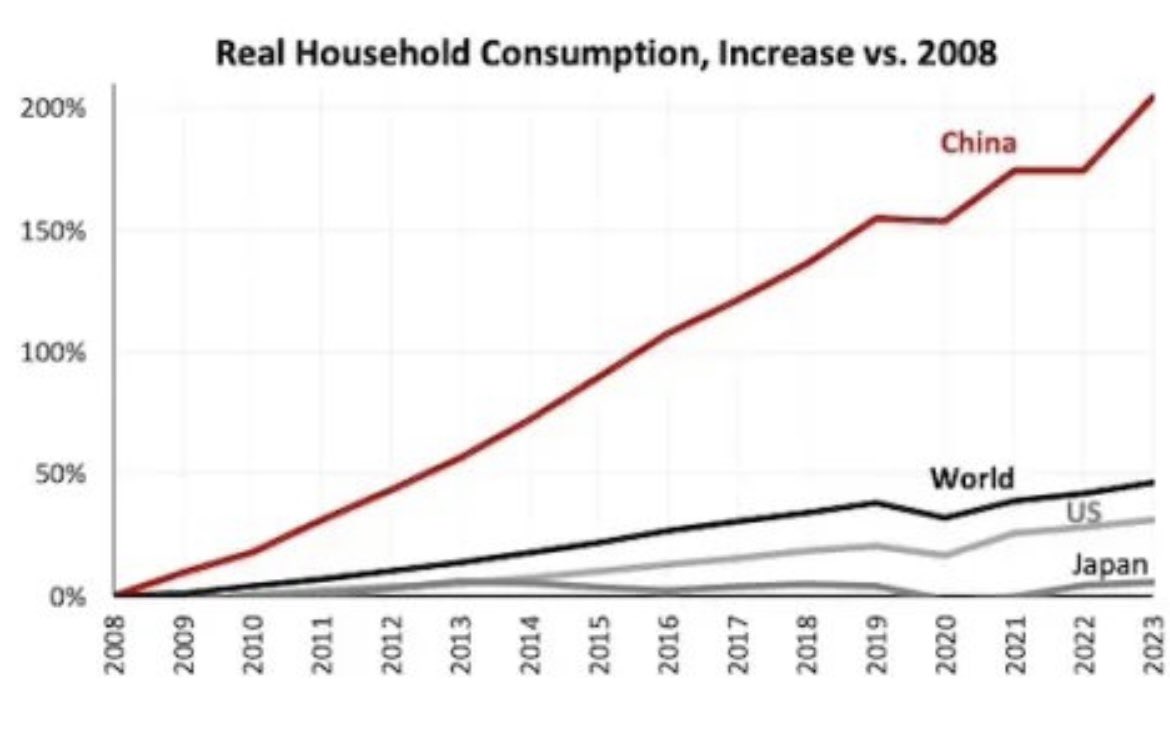

@[email protected] might be interested in this article since they often have noted that a big problem for China is its relatively weak Household consumption

https://asiatimes.com/2023/11/consumption-in-china-is-it-really-that-bad/

According to this perspective HH consumption in China is under-reported ,or more accuratly undercaclulated when comparing to numbers from other countries cause it uses different calculation methods, a soviet accountring approach that is, along with some other unique parameters tothe whole equation. And that if calculated in the same way as the HH consumption numbers of other countries China's household consumption as a % of GDP is actualy already in line or above its developed neighbours

Another thing i found that doesnt agree that Chinese HH consuption notably underperforms is that it has tracked the growth of GDP for since the GFC. Which is what would be healthy and expected. IMF data:

So while Chinese HH consumption has room to grow and is probably weak, maybe its already performing fine-ish enough that there isnt enough room to make China an internal circulation economy by boosting domestic consumption and there isnt enough internal consumption potential to absord its manufacturing and industrial capacity. And that the CPC itself cant really boost HH consumption significantly enough even if it tried its darnest

The author doesn’t understand the crux of the problem.

Of course, household consumption is up, but so too is the household debt!

Figure: Household debt to % of GDP, which more than doubled from <30% in 2011 to 62% in 2021

People are not only borrowing to spend, but the more perilous part is that a lot of those household (and corporate) debt are tied up in the inflating property bubble, which makes them particularly vulnerable to a property crisis (which is itself tied to the local government debt problems, forming a complex crisis that cannot be disentangled trivially). This is exactly why the Chinese government has to handle the situation so delicately - the measures are effective enough that thankfully China won’t experience the 2008 subprime mortgage crisis as it did in the US - but it is still a very challenging task to get out of this mess. If the bubble bursts, a lot of people are going to lose their wealth and we will be looking at a strong dampening of consumer demand.

A direct way to improve consumption is to increase budget deficit (China typically runs a 3% deficit but last year it broke the rule and went to 3.8% for the first time, still this is far from adequate to stimulate a weakening demand) - i.e. direct injection from the treasury (the government itself). This is the only way to increase the net financial asset of the private sector (including households) without having them to resort to borrowing, which is what the current case is.

While China, again thankfully, is not experiencing the same extent as the Great Depression in the 1920s, the nature of the problem remains the same: overproduction crisis plus weakening consumer demand. And it took the US a New Deal plus the War Economy during WWII to get out of the Great Depression! And it is very reasonable to believe that at the current level of budget deficit at 3-4% of GDP, China is going to have a difficult time with stimulating its economy.

Again, there are a lot of internet “experts” (this one under a pseudonym) these days present analyses that seem to make sense, if you’re not reading carefully, and I urge people to be wary of these (not that the mainstream media are any more useful, since they all spew neoclassical nonsense as well, but a lot of these analyses need to be read with a more critical eye).

As for my sources, I have made it very clear in the past that my personal perspective is strongly influenced by Jia Genliang’s approach - a well respected Marxist economist with a Marxian/MMT/Listian approach that I believe to be a very strong combination when it comes to understanding capitalist dynamics, the monetary system and international trade. Here is a recent Bloomberg article interviewing Jia Genliang (a rare appearance in Western media) last November clarifying the MMT position on China. I highly recommend reading it to get a sense of where my perspective comes from.

There is a reason why MMT proponents were easily able to predict that the US economy would not go into recession last year, in spite of what all the mainstream economists had so boldly claimed. It is very simple actually, once you understand how money and debt operate in the economy - at 8% GDP deficit spending, there is no way that the US would get into recession! Even when you take into account the fact that most of the money went into the rich people’s pockets, given the size of the US economy, there are still enough bread crumbs to stop the people from tightening their spending enough to plunge the economy into recession.

If China wants to develop its consumer base, it has to increase its budget deficit, there is no way around it. And a very easy indicator here is that at 3-4% of fiscal spending, it’s nowhere near enough to cope with the weakening external demand.

To not put talk past each other i wanna note that the general question that policy decisions and directions depend on still stands?. How high or low is Chinese HH consumption actualy? Is it 35% or 55% ? If it isnt actually noticably lagging other developed asian or even western nations when calculated in the same manner then one can say "china must develop its consumer base" all they want but there actually be much less room to do so compared to the assumed one if HH consumption was actualy noticably weak. Its a different thing to try and bring a notably weak consumption to developed nation averages vs trying to bring a maybe somewhat bellow average consumption to gargantuan US consumerist brain levels. If the latter is needed for China to become a internal circulation and non exporter then i question the validity of such project or even its feasibility in timescales of 1-2 decades, or if it could have done something about it earlier on.

https://fddi.fudan.edu.cn/d3/ae/c19095a185262/page.htm And its not just random unnamed bloggers. Actual research in China seems to be approaching these figures again and breaking down the pocibility of underestimating Chinese HH consumption compared to other countries due to accounting and economic particularities

As for dept i dont think household borrowing has played an important role in the increase of Chinese household consumption. Also the aggregated figure may tell us absolutely nothing about how distressed the average household balance sheet is given the income and regional inequalities in China. It could very well be an upper middle class problem and for housholds and individuals who leveraged a bit too much on the property market and speculation. Those people were gonna be losers in any restructuring and deflation, controlled or not, of the property sector either way. Its less of an issue if Hh debt going up mostly as a function of mortgage penetration for higher income earners but not coming at the expense of a savings or consumption (but also not financing consumption) for the average houshold. If we want to make this argument looking at income cohort specific data is the way to go if you have them available. And its something that seems to be plateauing and even dropping either way in the last couple of years while consumption continues to grow. But Overall households seem well above water in total net wealth with healthy balance sheets.

Doesnt seem thats holding back household spending and deposits also can’t grow (along with consumption) following income and gdp gains if debt servicing is what’s eating peoples incomes.

Once again you are missing the forest for the trees. Private sector debt absolute matters when we’re talking about consumption and consumer base.

The reason most of these analyses conveniently omit private sector debt when talking about household consumption is because neoliberal economists subscribed to the “supply and demand” theory of lending known as loanable funds, which sees no difference between bank credit creation and (government) money creation. For the neoliberals, it doesn’t matter who creates the money, people borrowing money (which is a liability they have to repay in the future) to consume is no different than people earning net financial income (fresh money created by the government) to consume. That’s why Ben Bernanke famously said in his Essays on the Great Depression: “Pure redistributions should have no significant macroeconomic effects.”

But private sector debt does matter. When your economy is heavily dependent on private credit, a recession will happen when people can no longer afford to borrow. Of course, on the surface you can say that 60% household to GDP ratio doesn’t look that bad, but it is the rate of change of the debt (second-order derivative) that matters. It is the velocity at which the private debt grows that is worrying, which doubled as proportion to the GDP in just a decade. Once the borrowing decelerates (goes negative in the second-order derivative), you are going to get into a recession. What’s more, more than half of Chinese household and corporate debt (private sector debt) are tied up in mortgage and real estate. When the housing price inevitably comes down, a lot of that wealth are going to get deleted. How to maneuver out of this mess is a major issue and needs to be delicately handled by the central government.

This is why a dampening of external demand combined with a rising household debt and property bubble can be dangerous for China. At 3-4% of budget deficit, it is nowhere near enough to offset these detrimental factors to the economy. I’m sure you’ve seen the news of deflation in China - this is when consumers begin to defer their purchases as they wait for prices to go down, which can lead to less spending and borrowing - and once that rate of credit growth turns negative, the economy could be in peril as dwindling demand will lead to downturn in production and the effects can quickly spread across the entire supply chain causing businesses to close down and rising unemployment. That’s when a recession begins.

The easiest way out as I have said in the previous post is for the government money printer to start printing tons of money to grow the household incomes so people actually have money to spend without having to borrow.

I don't agree with your economics which is essentially neoclassical, but I sort of agree with your proscription. The central government of China has very low debt and should spend a bunch of money. However, I think that people who suggest this miss the problem they have which is that they can't agree on what to spend the money on. The central committee won't agree on policies that just give money to people directly, for a variety of reasons some good and some bad, but it won't happen. In my view the central government could possibly agree to sending money to local governments in proportion to the number of citizens under them, which amounts to the same thing, and relieves the local government debt burdens somewhat. The fact that it hasn't happened yet obviously implies that there isn't sufficient agreement on that approach.

In general though I think people underestimate the degree to which the Chinese economy is just fine and needs no intervention at all. If factories start shutting down in a disorderly manner, that is obviously the time to bring down the hammer. But I suspect that there is a good chance it won't be necessary.