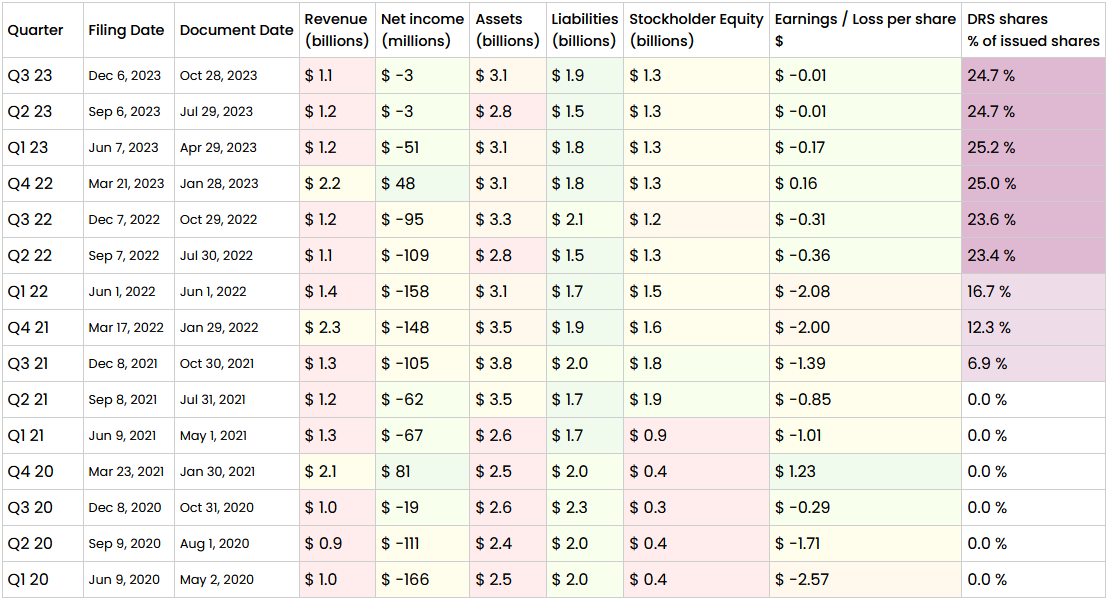

In order to achieve full-year profitability, GameStop will need to achieve a net income of + $57 million in Q4 2023.

DRS Your GME

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

Time to buy more games 💎👌

Net income Q4 2022 was $48 million, and their revenue during Q4 most years is around 2 Billion compared to around 1Billion for each of Q1, Q2, Q3.

This is beautiful, thanks for making this,

Also the DRS number is fake 0.0 change between quarters is the most telling part. I think the DTC is forcing GameStop to report this way

Note regarding earnings/loss per share, the stock-split was in July 2022 which is why there is a big jump between Q1 22 and Q2 22.

This is helpful, thanks!

We are going to have a profitable 2023. Compared with last year and 2021 the results are amazing.

Great spreadsheet! Thanks for the info!

Great chart –– it lets people make their own judgments based on the facts! I will give the bull case, and if you disagree, then feel free to give the bear case. For the latest quarter, stockholder equity is $1.3 billion, and net loss is $3 million. $1.3 billion / ($3 million / year) = 433.3 years. This is sufficient runway to turn the company around.

Revenue may be down $3 million, but cash and cash equivalents increased $15 million (from $1.195 billion to $1.210 billion). Doesn't this mean they're actually gaining money, just not from direct sales?