this post was submitted on 16 Jan 2024

88 points (92.3% liked)

DRS Your GME

1228 readers

1 users here now

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

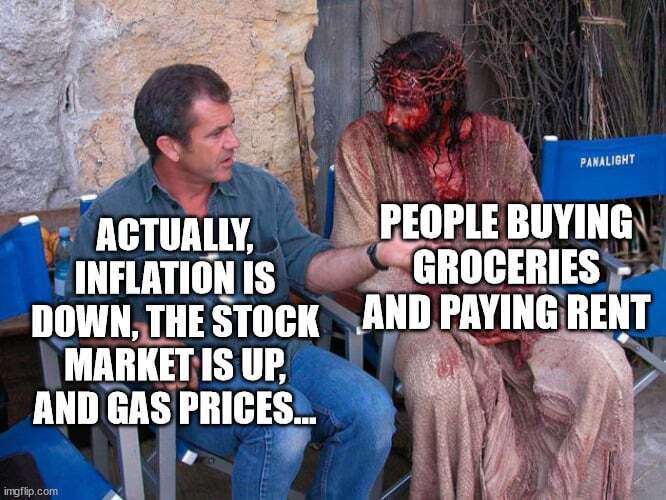

Inflation is down but it's not negative, which is the problem.

Deflation would be a bigger problem. It would mean lots of people with no jobs, still trying to afford high prices.

The problem right now is that wages are only catching up slowly, because labor bargaining power is squat due to low union participation and legal protection.

I would argue the heart of the problem- or at least a major component, is that so few companies control the market. I can go to a different grocery store if the prices are insane at only the nearest one. However, pretty much all grocery stores carry mostly the same products. Those products are owned by just a handful of companies.

Want a different cell service? There's just 3 companies left. Internet? You probably don't even have a choice.

It's pretty easy to jack up prices if there are no competitors left to swoop up your customers.

They can control their prices and does not have to gouge

True, I'm not sure if deflation with low-unemployment is economically possible but it would be nice.

Deflation is bad because you can "invest" by just keeping cash around. Which means investors aren't contributing to economic activity.

A small amount of inflation helps, because investors understand that if they're not investing the cash they have, then they're essentially losing money.

High levels of inflation is bad, because prices can change so fast that it makes commerce too difficult with prices changing too frequently.

But that's for stable levels. Salaries tend to be very vulnerable to unexpected changes in inflation/deflation because they don't change that often and they're not pegged to inflation. Which means if the money unexpectedly devalues by 20%, then you effectively get a 20% pay cut and it might not be easy to negation a rectification with your employer and meanwhile you're still underpaid.

The reverse is true with unexpected deflation, you get an effective 20% pay raise and your employer can't do anything about it except fire you or go bankrupt. This is how deflation can lead to unemployment.

So deflation might help make a bit of wealth transfer from the capitalist class to the working class. But it's very temporary and would likely come at a great cost to the overall economy.

If you want to fix wealth inequality it's really simple: tax the rich, regulate monopolies and oligopolies.