Personal Income Spending Flowchart (Canada)

(lemmy.ca)

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 21 Jun 2023

12 points (100.0% liked)

Personal Finance Canada

1638 readers

1 users here now

Come and discuss anything related to personal finance, directly or indirectly, with other Canadians!

founded 2 years ago

MODERATORS

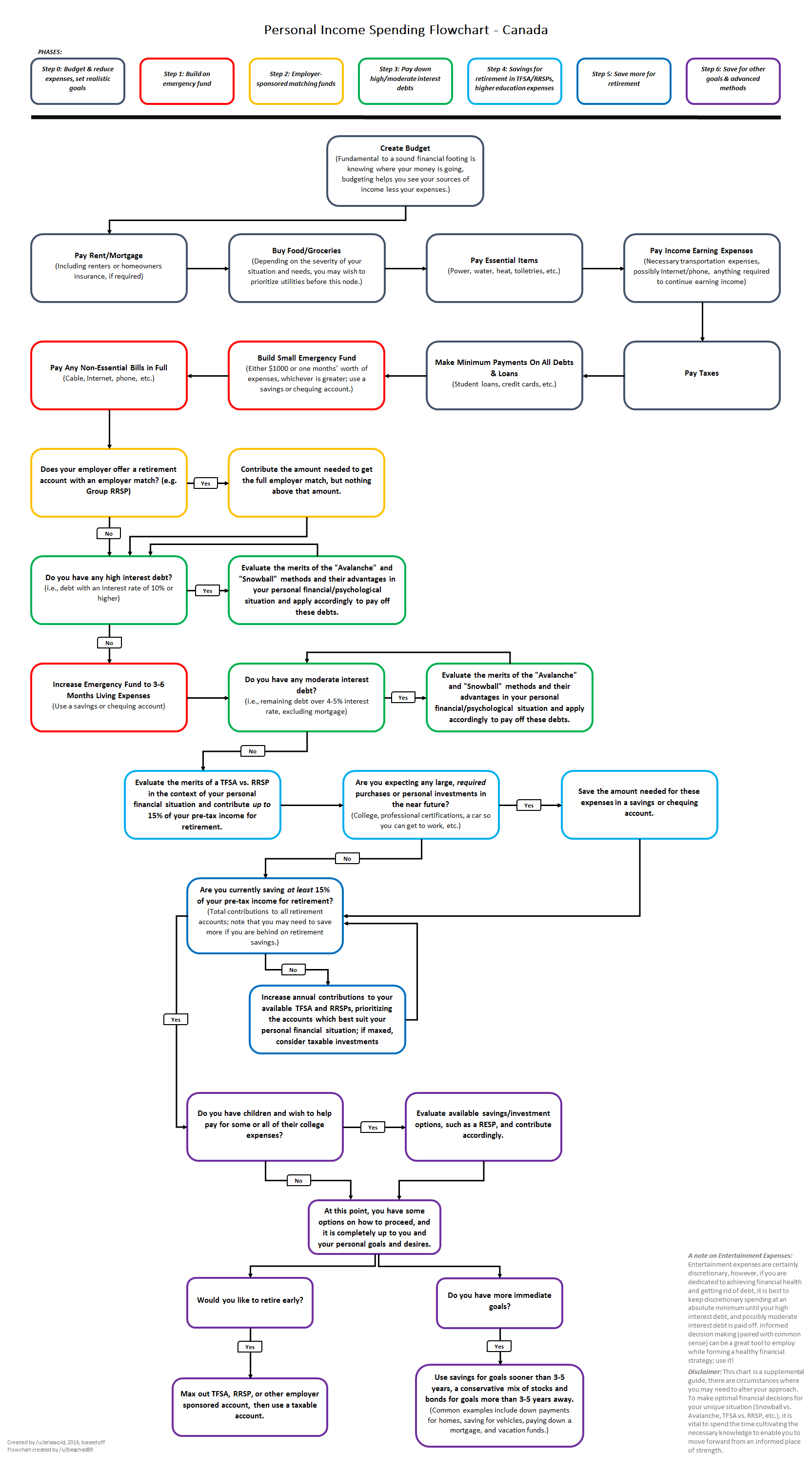

Interesting take: how would you put it higher? IMO, almost all the previous steps (except the one about employer match) are related to living expenses, which are in my opinion more important than something that can be cleared through bankruptcy, so I don't see how that could move much higher.

I’d put it above a small emergency fund, which you need precisely to avoid bad debt. It hardly makes sense to set aside $1000 when you have $1000 in CC debt. I’d also put it above non-essential bills. That list is weird because I would consider cell phone and internet absolutely essential. But if it’s truly non-essential, like cable or a game subscription, I would cancel until I don’t have bad debt.

The employer match is actually maybe the only one I might keep, since you get an instant 100% ROI.