the_dunk_tank

It's the dunk tank.

This is where you come to post big-brained hot takes by chuds, libs, or even fellow leftists, and tear them to itty-bitty pieces with precision dunkstrikes.

Rule 1: All posts must include links to the subject matter, and no identifying information should be redacted.

Rule 2: If your source is a reactionary website, please use archive.is instead of linking directly.

Rule 3: No sectarianism.

Rule 4: TERF/SWERFs Not Welcome

Rule 5: No ableism of any kind (that includes stuff like libt*rd)

Rule 6: Do not post fellow hexbears.

Rule 7: Do not individually target other instances' admins or moderators.

Rule 8: The subject of a post cannot be low hanging fruit, that is comments/posts made by a private person that have low amount of upvotes/likes/views. Comments/Posts made on other instances that are accessible from hexbear are an exception to this. Posts that do not meet this requirement can be posted to [email protected]

Rule 9: if you post ironic rage bait im going to make a personal visit to your house to make sure you never make this mistake again

view the rest of the comments

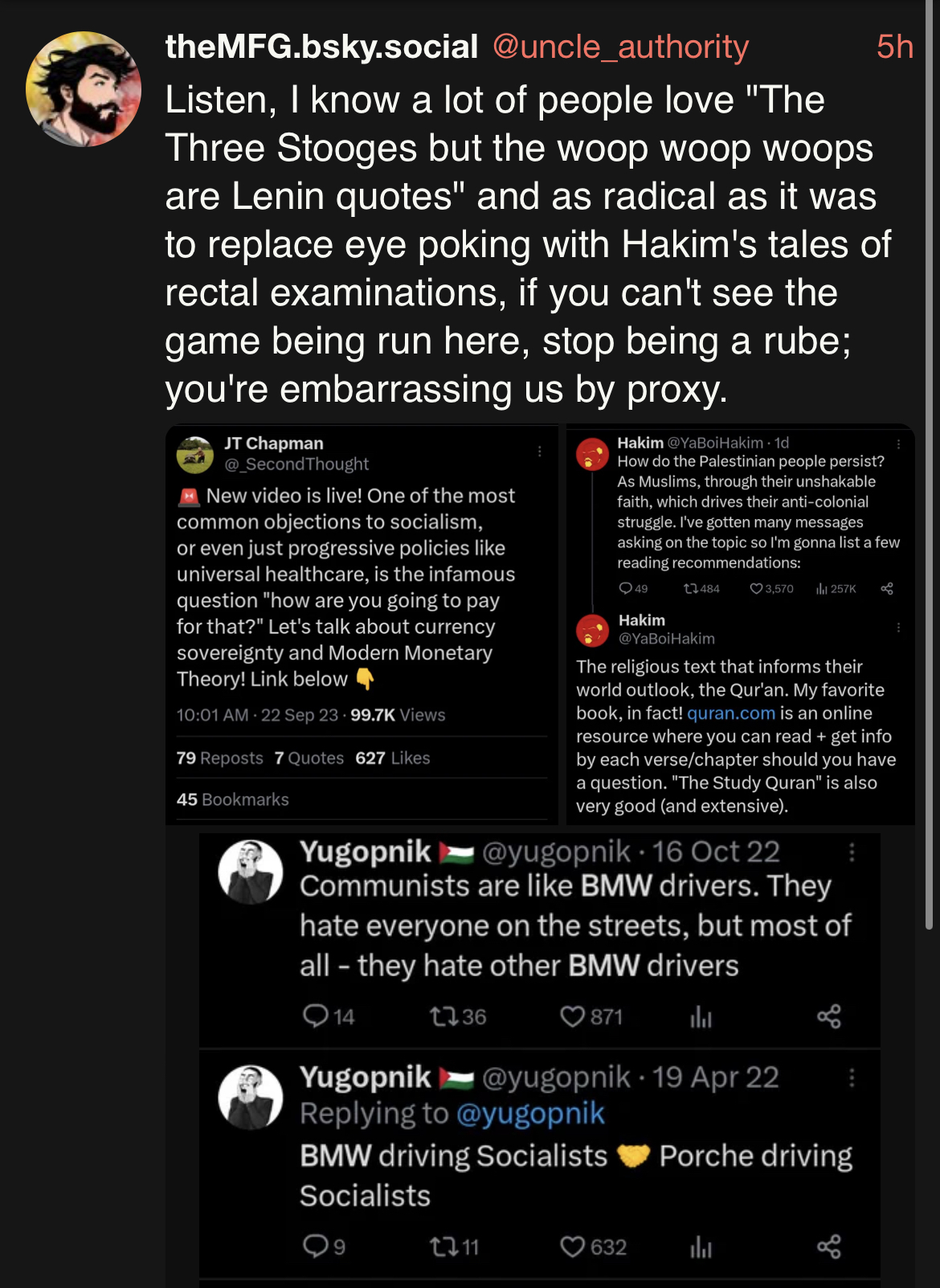

that's not really true, all economics is political and mmt is dripping with reformism trying to solve the problems of capitalism in the sphere of distribution instead of production, it muddles class realities by suggesting that "we" could print money to pay for things that "we" want while nudging class rule and dollar imperialism behind the sofa. marxist spaces are brimming with well-read people whose eyes roll back in their head when someone's naive enough to give mmt a sympathetic treatment, and roderick was channeling that annoyance

similarly he feels confident in taking shots here bc of the sort of ambient skepticism toward hakim's religiosity that others have voiced a thousand times before

his problem is that he's a professional twitter user who doesn't know how to shut up and with only 140 characters he ends up shadowboxing with, like, context that's totally foreign to anyone not already plugged in to the capital d discourse

Sometimes some crappy pseudo leftist political parties push it like that but in a marxist context it doesn't have to be.

In the lower phase of socialism you're still gonna have money, and MMT seems to be the most coherent idea on how to handle money, that's it. It's a tool, not an ideology in of itself.

The real problem with MMT isn't that it's reformist, it's that not that many countries today have truly sovereign currencies.

Can you elaborate? Because this is a very contrived view of MMT, which is essentially just a lens into understanding how money works.

Michael Hudson has written a lot about this in his books Super Imperialism, Killing the Host and Destiny of Civilization.

You do realize that MMT is derived from Marxism, right?

Michael Hudson is a Marxist. Minsky (Stephanie Kelton’s PhD advisor), whose work formed the foundation of MMT, was a Marxist (confirmed by Hudson).

mmt even strictly as an economic theory separated from macroeconomic policy isn't really descended from marx, my understanding is that there was maybe a little bit of interplay way back when liberal economists weren't sure yet that fiat could work as a money commodity but after that all of these related ideas like role of the state in guaranteeing public welfare with monetary policy and the idea of inflation as a substitution for taxation flowered independently within bourgeois economics, and that's what mmt as formulated today draws on. it's not surprising, economics is the priesthood of capital; financial capital is ascendent but monetarism doesn't work to check the destructive instability of free markets, the inefficiencies of specie and taxation are a constraint on growth, and mmt's explanations in terms of circulation suggest solutions that avoid challenging relations of production. it's not contrived, this is the actual social basis for the development of the theory. you can see premonitions of this in marx's time, proudhon argued against liberal monetary policy from a petty bourgeois perspective (i.e. while maintaining private production) but marx insisted that he and the liberal economists were all missing the real point that production ultimately gives rise to money and not the other way around:

production begets money which feeds back to further production, but production is the primary regulator. you can try to find insights in mmt if you want to flesh out the money->production leg of the dialectical loop - hudson leans (way too) hard into this and graeber flips the precedence entirely upside down - but since mmt as such was developed to exist as a myopic slice of "the question in its pure form" I think it's fair to say that it's non-marxist

Exactly, MMT is Keynesianism for the 21st century.

I like this comment on the blogpost:

I meant to add before that I first ran into mmt in my phase years ago of being fascinated by the market and listening to every hour of every bloomberg podcast for like 18 months. I remember that joe weisenthal and tracy alloway kept having mmt people on their podcast over and over and over to critique the fed and talk about mmt, and that really goes to show how comfortable that section of the bourgeoisie is with accommodating this whole idea. as long as you only address circulation, finance capital keeps benefiting in distribution, and nothing shakes its foundation in production. if you flip it on its head and start talking about changing relations of production you end up in a black plastic bag behind bloomberg's mansion on long island

Yeah and the critiques amount to "austerity politics is stupid, causes recessions, is simply capital inflicting wounds on itself, the government should spend money and it would be better for everyone", without thinking about why austerity makes sense to capital. Keynesianism rebranded for the 21st century

https://thenextrecession.wordpress.com/2017/07/13/will-reversing-austerity-end-the-depression/