this post was submitted on 11 Aug 2023

18 points (76.5% liked)

Personal Finance

3799 readers

1 users here now

Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. Join our community, read the PF Wiki, and get on top of your finances!

Note: This community is not region centric, so if you are posting anything specific to a certain region, kindly specify that in the title (something like [USA], [EU], [AUS] etc.)

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

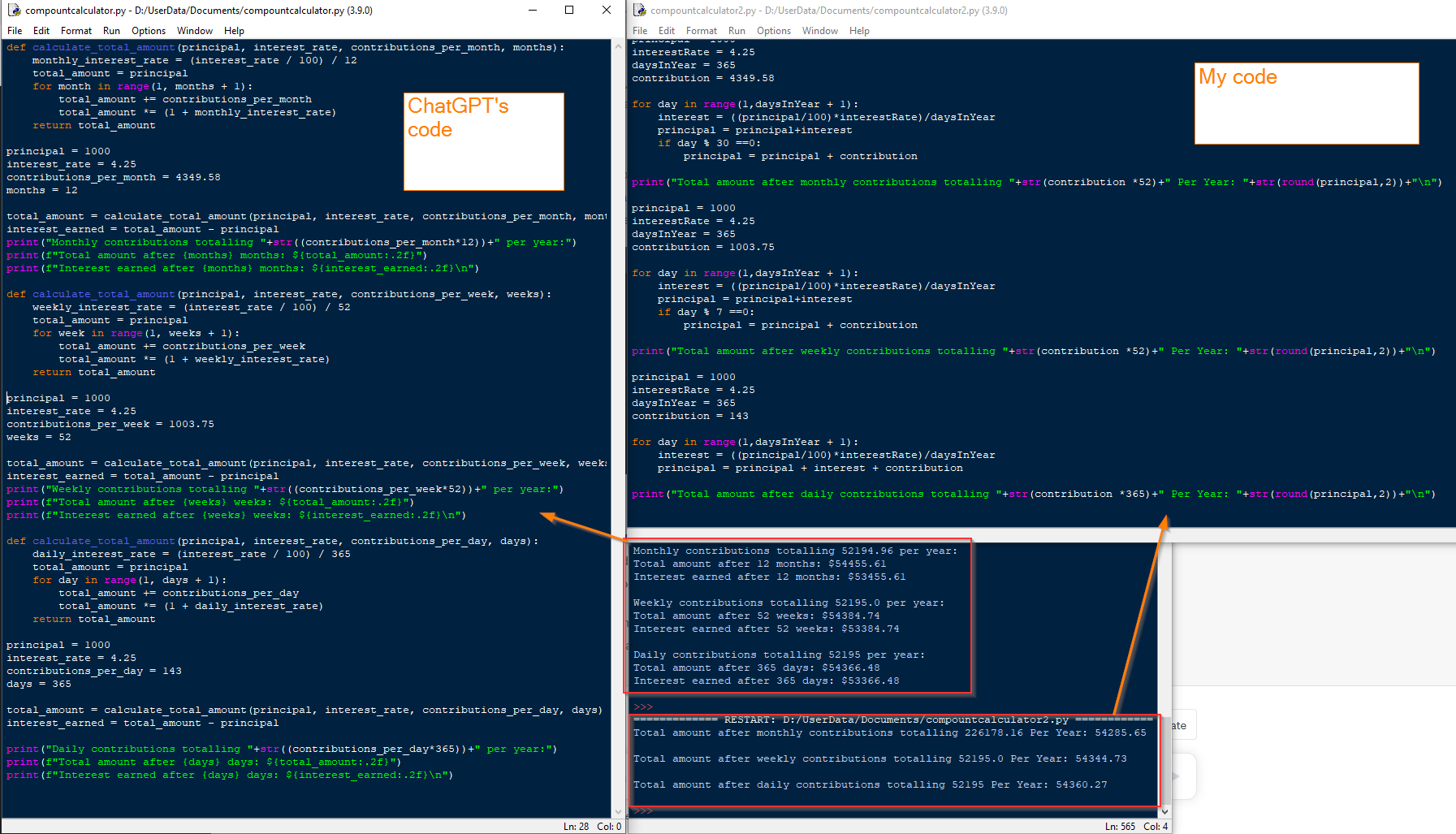

No need to use a script, you can put the numbers directly into a financial calculator and use the TVM feature, or use the annuity formula directly (or annuity due if investing at the start of a period).

If you invest at the end of the period, daily is better, as more money will compound longer (vs waiting until the end of the month) If you invest at the beginning of the period, monthly is better (invest every at the beginning of the month)

Example with investing at end of period:

This is assuming you compound every day, as in practice, day count conventions may be different, and ignoring things such as the opportunity cost of the time spent time logging in to your bank to make daily transfers