this post was submitted on 17 May 2024

677 points (97.7% liked)

Data Is Beautiful

6909 readers

2 users here now

A place to share and discuss data visualizations. #dataviz

(under new moderation as of 2024-01, please let me know if there are any changes you want to see!)

founded 3 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

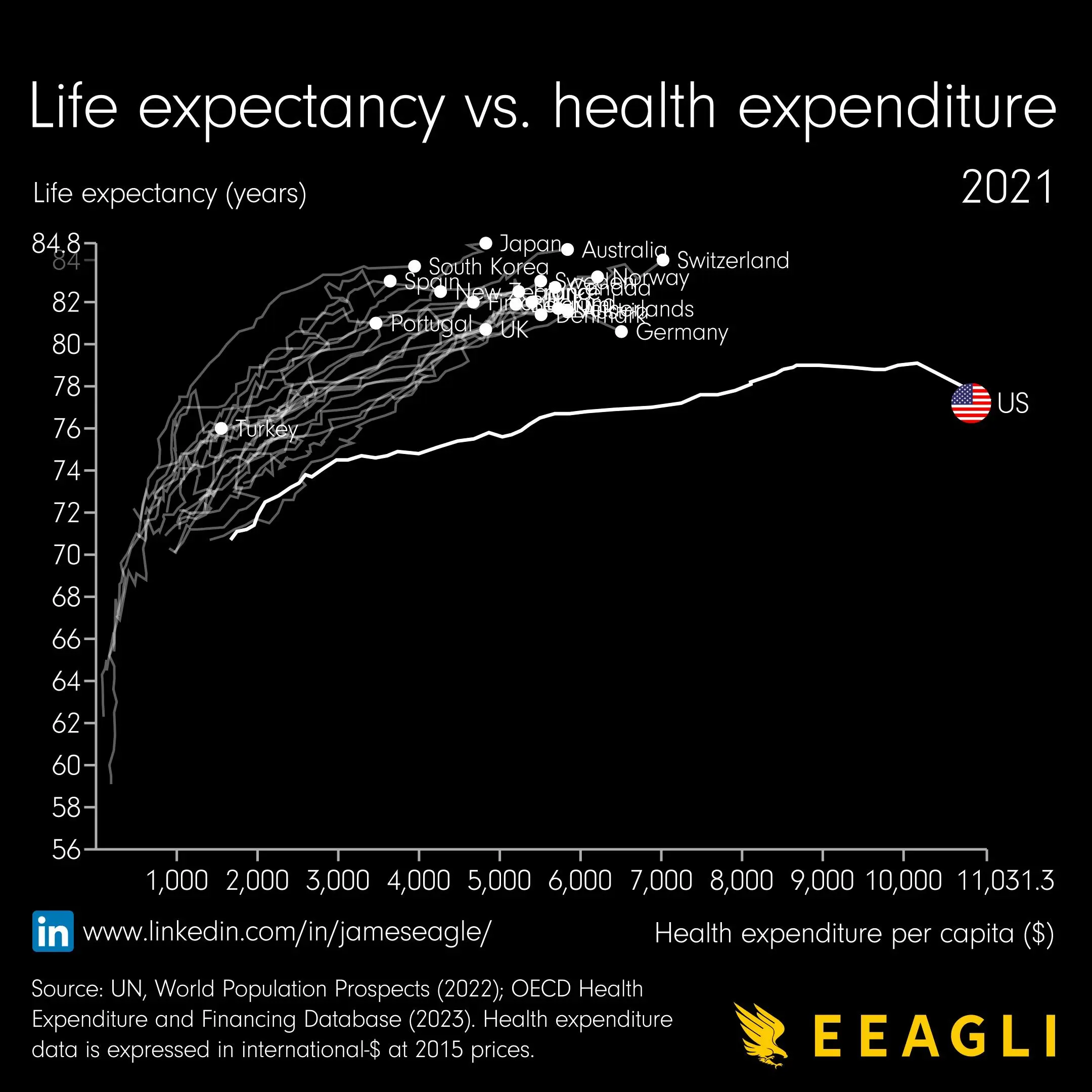

I have an honors minor in medical humanities and took several medical policy courses. We looked at this exact graph from previous years as well as several other huge sets of data/graphs/studies and anything else related to insurance you can imagine. Insurance is not a standard market commodity and does not follow the same trend or logic. The only way you can lower premiums in insurance is by reducing the risk in the pool, or increasing the pool size to dilute the risk. This is either increasing the total pool size by increasing premiums, getting more people, or being selective about who joins the risk pool. The third one was what was called "preexisting conditions" and kept high cost people from entering the risk pool and draining the funds. This got banned and increased premiums. By increasing competition you end up splitting up the pools, making everyone's premiums go up. This happened multiple times post ACA after the GOP started stripping out the funding and safeguards to prevent this. More and more competition opened up with artificially low premiums being subsidized by federal dollars, but then when the subsidies ended the premiums started jumping. Then when the premiums were jumping, new companies opened up to make more competition advertising lower rates, but then further fractured to pool sizes, leading to premiums skyrocketing. If you look back just 10 years ago there was a 3-5 year stretch of premiums increasing almost 30% year after year. It was due to all the competition opening up every year. This is why single payer systems have the lowest rates. If you have even one private company monopoly with a regulated cap on profits you would still end up with lower premiums. Then, if this single paying company was nationalized to take out the profit making middle man, the premiums are that much lower because your risk is spread across a massive pool. More competition in insurance makes the problem worse. I would agree with your stronger regulation though. There is a lot that can be done there.

Thanks for your insight!